News

Santa Cruz City Short Term Rental Ordinance Approved by Coastal Commission.

In an eight to two vote the California Coastal Commission approved of the city's short term rental regulations at its April 11, 2018 meeting in Redondo Beach, CA.

Commission staff had recommended that the city's ordinance be denied or redrafted to allow more short term rental activity in the coastal zone.

Led by commissioner Aaron Peskin, coastal commissioners focused on the extreme housing need in Santa Cruz and the pressure put on housing from UCSC growth.

This approval now assures final implementation of the city ordinance that represents rule changes following over a year of public input.

City Council Approves Permissive STR Ordinance.

On October 24, 2017 the city council finalized it's first short term rental ordinance that grandfathers in existing STRs that are registered with the Finance Department and allows for 250 more STR permits for hosts who live on the property they are renting.

This ordinance halts any new permits for un-hosted STRs where an owner does not live onsite. It also creates development standards for new STRs with regards to parking and public safety.

Existing unregistered STR owners can apply for the 250 new permits but will be required to pay back occupancy taxes before a permit is issued.

You can read the final ordinance here.

Planning Commission Rejects Recommendations from STR Subcommittee.

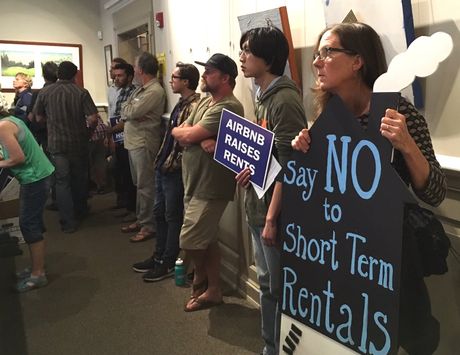

On July 20, 2017 the Santa Cruz City Planning Commission finalized a draft ordinance that will be forwarded to the City Council for review, amendment and implementation in the Fall of 2017. At a public hearing attended by 75 local residents the commission heard testimony from 43 concerned citizens. At 12:30am the commission finalized their draft ordinance. It was a rough night for the proponents of short term rentals. The commission rolled back every recommendation from the city's STR subcommittee. The subcommittee, dominated by short term rental operators and proponents, were recommending permissive regulations that would have allowed unlimited growth of short term rentals in the city. To see a score card of what the subcommittee recommended and what the planning commission decided click here.

Planning Commission sets Second Meeting on STR's.

On June 29th the Santa Cruz City Planning Commission started a discussion on a draft STR ordinance created by city staff. 100 people were in attendance. The discussion went on till 12:15am when the Commission chair decided to end the meeting and continue their discussion on July 20th at 7pm. No final decisions on the ordinance have been made. The public is invited to come to the July 20th meeting at 7pm in the City Council Chambers.

City Staff Recommends 400 Total STR's to Commission

In advance of the June 29th Planning Commission meeting city planners have drafted an ordinance for the commissioners to review. The draft caps all STR's (hosted and unhosted) at 400 permits. It grants licenses for 5 years, limits new permits to one per owner, and subjects properties to annual rental inspections. The staff report also includes an alternative approach limiting STR's to the coastal zone. You can read the entire staff report and draft ordinance here.

Airbnb Boom is Emptying Historic Italian Cities

The Telegraph Newspaper is reporting a trend in Italy's most historic cities. The most desirable parts of the city are being emptied of residents in favor of Airbnb tourist accommodations. In central Florence 20% of the housing is now advertised on Airbnb. This trend changes the nature of these cities, making them into tourist theme parks and raises prices for local goods as shopkeepers increase prices to match tourist demand. Read the entire article here.

NBC Affiliate in Los Angeles Investigates Illegal Airbnbs.

Channel 4 news in Los Angeles has done a nice investigative piece on the rise of Airbnb and the effect it is having on desirable neighborhoods in the LA area. They talk about neighborhood disturbances, Airbnb's inaction on complaints, and the effect of short term rentals on housing availability. This is one of the better reports on the issue of professional operators listing multiple properties. In this case they confront an Airbnb host who leases desirable units and re rents them on Airbnb. See the video here.

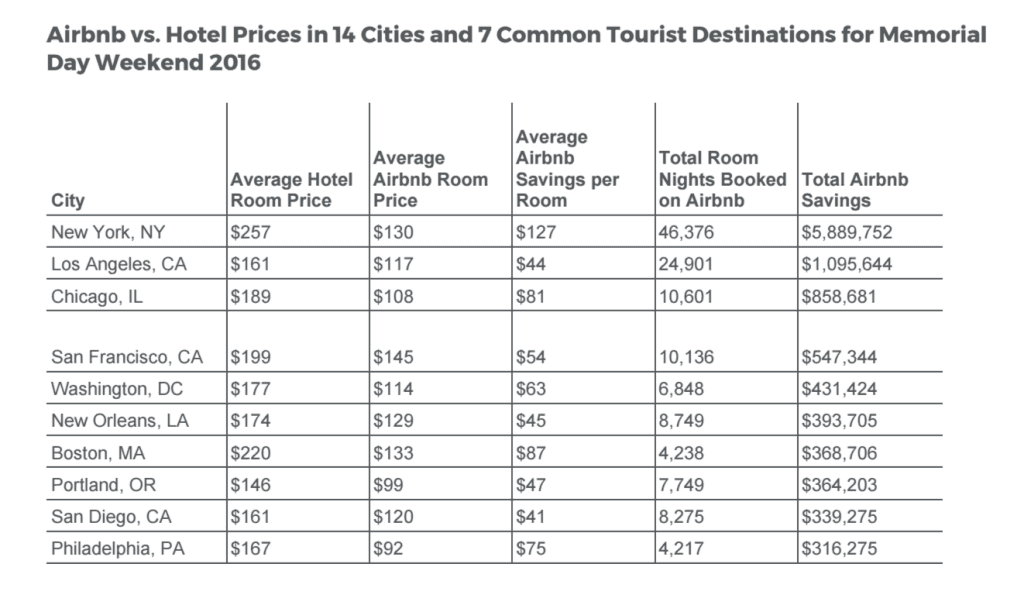

Airbnb Brags it Saves Money on Memorial Day Weekend and Exposes the Problem of Lower Tax Revenues for Cities.

On Memorial Day weekend 2017 Airbnb released pricing and occupancy data from one year ago to show that travelers saved money by booking through them. The chart at left was released by Airbnb for 10 cities in the US. This chart is a cautionary tale for cities who care about occupancy tax revenues. Using San Francisco as an example: $547,344 was saved in one weekend. With a 14% hotel tax in S.F. the city lost over $76,000 in revenue over what it would have received had those travelers stayed in hotels. New York lost over $386,000 in one weekend.

City Hall Extends the Short Term Rental Moratorium on a Unanimous Vote.

On Tuesday, May 9, 2017 the Santa Cruz City Council extended the city's Short Term Rental Moratorium that was originally passed in October, 2016. The 12 month extension takes the moratorium out to May 31, 2018. This now gives the city time to have an ordinance debated at the Planning Commission on June 29, 2017 and then a full city council debate sometime in October or November 2017. After passage the ordinance must be approved by the California Coastal Commission. City staff are hoping to get all these items checked off before May 31, 2018.

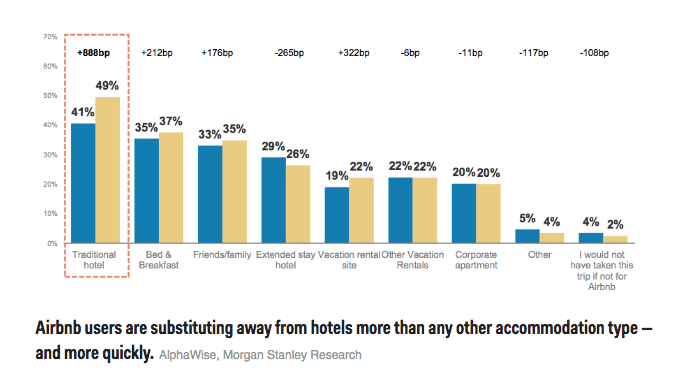

Airbnb is Not Creating New Customers. Just Shifting Guests from Hotels and B&Bs.

One claim of Airbnb proponents is that they are bringing new customers to the city and generating tax revenues that the city would not otherwise see. In 2016 investment banking firm Morgan Stanley conducted a study to determine if this was true. It turns out that only 2% of Airbnb users would not travel if they couldn't use Airbnb. 98% of Airbnb users would travel and stay in another form of accommodation. The chart at left shows the breakdown of preferences by Airbnb guests. The blue bars are from 2015. The tan bars are from 2016. You can read a Business Insider article on the study here.

Los Angeles NBC Investigates Airbnb.

In March 2017 the NBC news affiliate in Los Angeles investigated Airbnb listings in residential districts after neighbors complained about late night parties and guests constantly coming and going. The report uncovered one of the distinctive flaws in Airbnb listings....acountability. Often, the host of an Airbnb listing is not the property owner and is not accountable to the city, the property owners, neighbors, or anyone but themselves. You can see the four minute video here.

Airbnb Founder Admits Housing Losses.

On March 13, 2017 Brian Chesky (the founder and CEO of Airbnb) was interviewed on stage by Fortune Magazine editor Leigh Gallagher as part of a New York Economic Club lunch meeting. In response to a question about Airbnb and long term housing he said:

“When we started Airbnb, we didn’t fathom millions of people doing this. So I did not consider landlords. I didn’t consider cities. It was so bigger than what our idea was. Our idea was just to bring two people together. It grew so fast. There were substantive problems, a phenomenon that occurred where landlords saw they could make a lot of money taking units off the market and renting them on a short-term basis."

White Paper Calls Airbnb Tax Deals Unfair.

This month (March 2017) a comprehensive report was released on the occupancy tax side deals Airbnb has made with over 200 cities and municipalities. It was written by Dan Bucks who served as the Director of Revenue for the State of Montana. In his 55 page report Bucks identifies the pitfalls for cities that cut a special deal with Airbnb. Bucks writes:

“The Airbnb agreements do not guarantee accountability for the proper payment of lodging taxes because tax agencies cede substantial control of the payment and audit processes to Airbnb. The agreements provide a shield of secrecy for lodging operators that prevents their discovery by public agencies and creates a de facto tax and regulatory haven for those operators."